Indirect Costs

This optional-use screen is designed to automate the calculation of indirect costs within the general operating fund. To use this screen, navigate to it and select 'Yes' to confirm application of the Indirect Costs assumption.

For LEAs that have the resource and/or object setting set to 'NonSACS' in the 'LEA Data' 'Settings' tab, a custom object code must be referenced to 7310 Transfers of Indirect Costs SACS object code in the 'Chart of Accounts' for the 'Indirect Costs' screen to function.

For LEAs that have the resource and/or object setting set to 'NonSACS' in the 'LEA Data' 'Settings' tab, a custom object code must be referenced to 7310 Transfers of Indirect Costs SACS object code in the 'Chart of Accounts' for the 'Indirect Costs' screen to function.

What are Indirect Costs

The California Department of Education's (CDE's) guidance manual, the California School Accounting Manual (CSAM), defines indirect costs as:

Agency-wide general management costs not readily identifiable with a particular program but necessary for the overall operation of the agency (e.g., costs of accounting, budgeting, payroll preparation, personnel management, purchasing, warehousing, centralized data processing).

These costs are charged annually to each program resource within the general fund using SACS object 7310, Transfers of Indirect Costs.

Funding applications or award letters should be consulted to determine whether programs limit or prohibit the claiming of indirect costs. Common limitations include:

- Limiting the indirect cost rate to the lesser of the LEA's approved rate or a program's capped rate.

- Having an administrative cost cap that limits the combination of direct program administration and indirect costs charged to the program.

- Not allowing indirect costs.

For more information regarding indirect costs, please see the following CDE resources:

Because indirect costs are a transfer from restricted to unrestricted sources, miscalculations impact an LEA's reserve and may play a role in an LEA's fiscal distress.

Rate Sources

System Defaults

FCMAT creates and maintains system defaults based on publicly available information from the California Department of Education (CDE).

Approved indirect cost rates for LEAs are posted online annually on CDE's Indirect Cost Rates web page, usually in early spring. These rates are imported into the system as defaults when they become available.

The default program resource rates established in the software are based on information available in the CDE's PCAs and Associated Resources spreadsheet.

LEA Data

The LEA Admin can customize the system default rates in the LEA Data Indirect Cost Rates screen. The LEA Data rates will supersede system defaults when creating a new projection.

Projection

The rates can be modified within an individual projection to create alternative scenarios.

Sections

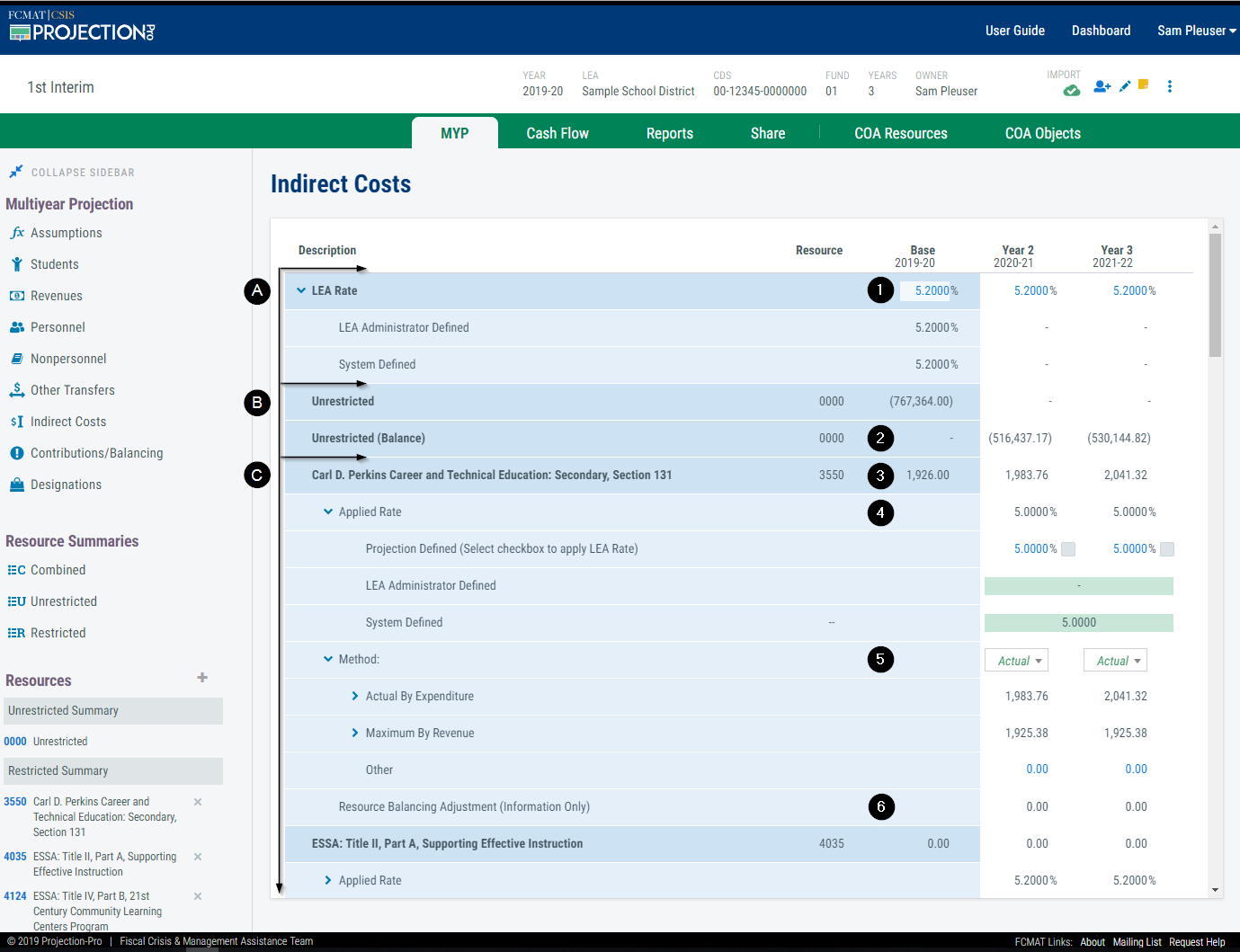

The Indirect Costs screen contains three sections:

A. LEA Rate

B. Unrestricted Resource

C. Other Resources

LEA Rate

The first step to calculating indirect costs is determining the applied LEA rate. Expand the LEA Rate row to display the current default LEA rates from the system and LEA Data.

1. LEA Rate Applied

For new projections, the 'LEA Rate' is determined by applying the 'LEA Administrator Defined' rate, if it exists, or the 'System Defined' rate. If neither rate exists in the base year, the default is 0.00%. If neither rate exists in a projected year, the default LEA Rate is the prior year rate.

Once a projection is created, the 'LEA Rate' is held constant unless manually updated. This permits the projection to be retained as a snapshot in time even if the LEA or system defined rates are updated in the future.

Unrestricted Resource

When calculating the LEA rate, indirect costs are accumulated in the general operating fund's unrestricted resources. Then, when the indirect costs are charged, the costs are transferred from restricted resources to the unrestricted resource. Indirect costs, SACS object 7310, must net to $0 within the general operating fund.

The unrestricted resource, code 0000, is represented on two rows. The first row, 'Unrestricted,' is the value imported into resource 0000 in the base year. The imported value may be manually updated on the Resources screen, but it is not calculated to balance the restricted resources in the base year.

2. Unrestricted Balance Applied

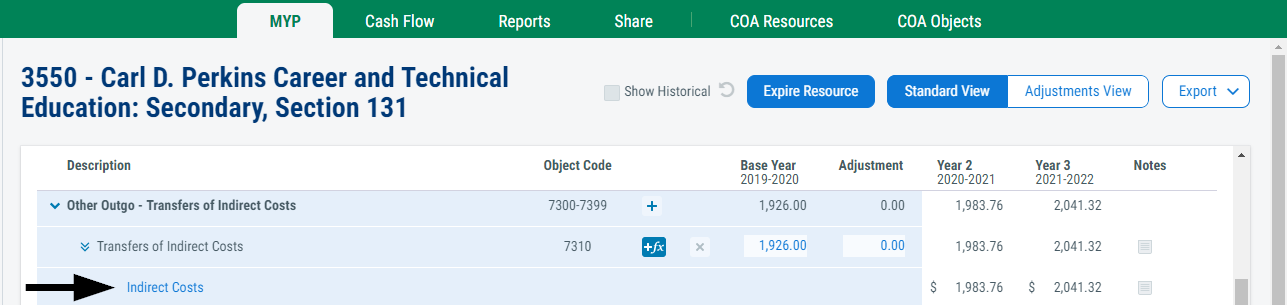

The 'Unrestricted (Balance)' row displays the projection for the unrestricted resource, code 0000. It is calculated by summing the indirect costs, object 7310, for all other resources and offsetting it to balance to $0 within the fund. These values are applied in the multiyear projection as the 'Indirect Costs' assumption.

Other Resources

All resources in the projection are automatically displayed in this screen; therefore, resources cannot be directly added or removed in this screen. To remove a resource from the projection, delete the resource from the 'Resources' section of the sidebar.

The first row for each resource contains the resource title, code and projected indirect cost value. Below are two expandable rows, 'Applied Rate' and 'Method,' and one informational row, 'Resource Balancing Adjustment.'

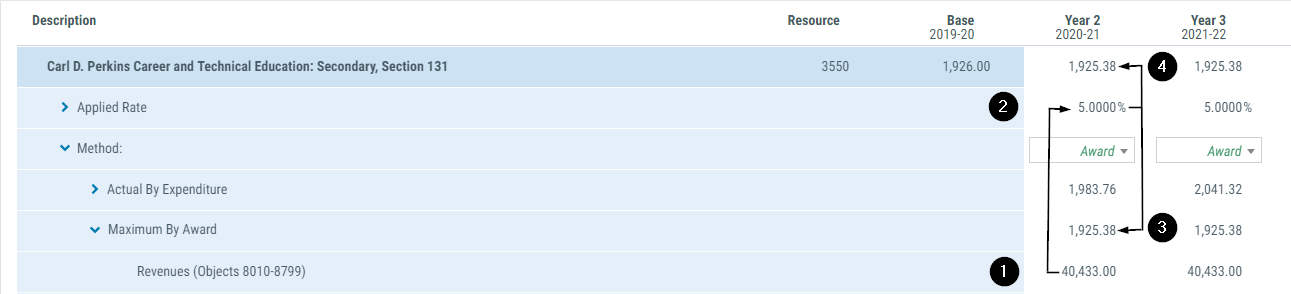

3. Indirect Costs Applied

The base year value is imported as part of the base year or can be manually updated on the Resources screen.

The projected years are calculated per the method selected:

- Expenditures Applied Rate x Net Expenditures

- Revenues

Applied Rate x Revenues - Other Manual entry

The results are rounded to the nearest penny.

4. Resource Rate Applied

The 'Applied Rate' is determined by comparing the LEA Rate and the 'Projection Defined' rate and returning the lower of the two rates. The 'Applied Rate' is used to calculate indirect costs for the resource.

For new projections, the 'Projection Defined' rate is determined by applying the 'LEA Administrator Defined' rate, if it exists, or the 'System Defined' rate. For custom resources, the 'System Defined' rate is based on the SACS reference. If neither rate exists, the default rate is 0.00%.

Once a projection is created, the 'Projection Defined' rate is static unless manually updated. This permits the projection to be retained as a snapshot in time even if the LEA or system defined rates are updated in the future.

The resource 'Projection Defined' rate can be set to either a percentage or 'LEA Rate':

- Use 'LEA Rate' by checking the box when the program has no limitations.

- If the resource has a capped rate, enter the capped rate in the percentage field.

- If the resource disallows indirect costs, enter a 0.00% rate in the percentage field.

See What are Indirect Costs for more information on limitations.

LEAs have the option to charge less than the approved rate when recovering indirect costs. However, indirect costs not claimed under one award may not be shifted to another award unless specifically authorized by legislation or regulation.

5. Calculation Options

The CSAM outlines two primary methods for projecting indirect costs:

-

'Actual by Expenditures' (default)

Projects indirect costs based on budgeted expenditures. This method is useful to project the full actual cost of a program, especially when expenditures exceed the award amount in a projected year. This is the default method because it aligns with the actual methodology required in preparing the unaudited actuals. -

'Maximum by Award'

Projects indirect costs to fit within the award amount rather than add them to the award amount. This method is permitted for budgeting only and is useful to reserve indirect costs when the entire award is not budgeted but is expected to be expended. This method may overstate indirect costs if the award is not expended in the year of the award.

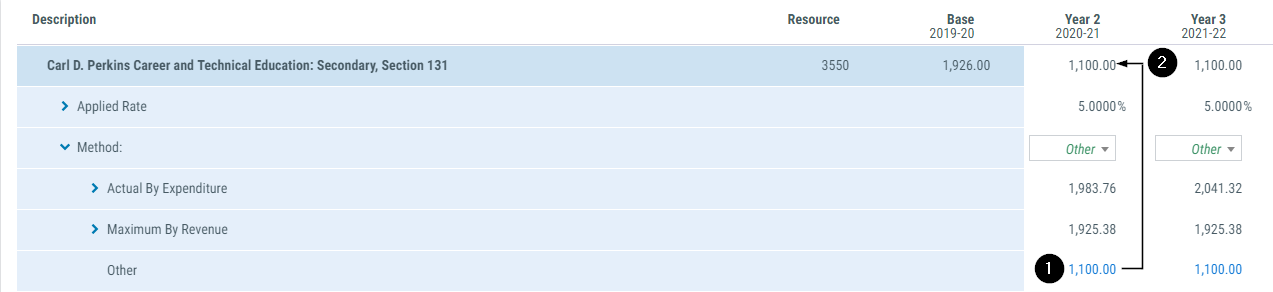

A third method is offered in the software, 'Other,' for use when neither of the above automated methods calculates the desired result due to special program restrictions or local processes or policies.

The method is set by year for resource by selecting the option from the drop-down box.

Actual by Expenditures

This method multiplies the total direct costs of the award (SACS objects 1000-5999), less any excluded costs (SACS objects 5100-5199), by the restricted indirect cost rate. Custom object codes are included in the calculation based on the SACS reference.

This method automatically recalculates as changes are made in the multiyear projection.

| Description | Year 2 | Year 3 |

|---|---|---|

| 1. Retrieve the expenditures in the resource from the 'Resources' screen, SACS objects 5000-5999 | $39,675.16 | $40,826.37 |

| 2. Retrieve the excluded expenditures, SACS objects 5100-5199 | $0.00 | $0.00 |

| 3. Calculate the net expenditures (1 minus 2) | $39,675.16 - $0.00 = $39,675.16 | $40,826.37 - $0.00 = $40,826.37 |

| 4. Retrieve the 'Applied Rate' | 5.0000% | 5.0000% |

| 5. Multiply the net expenditures by the 'Applied Rate' | $39,675.16 x 5.0000% = $1,983.76 | $40,826.37 x 5.0000% = $2,041.32 |

| 6. Apply the result in the 'Indirect Costs' assumption | $1,983.76 | $2,041.32 |

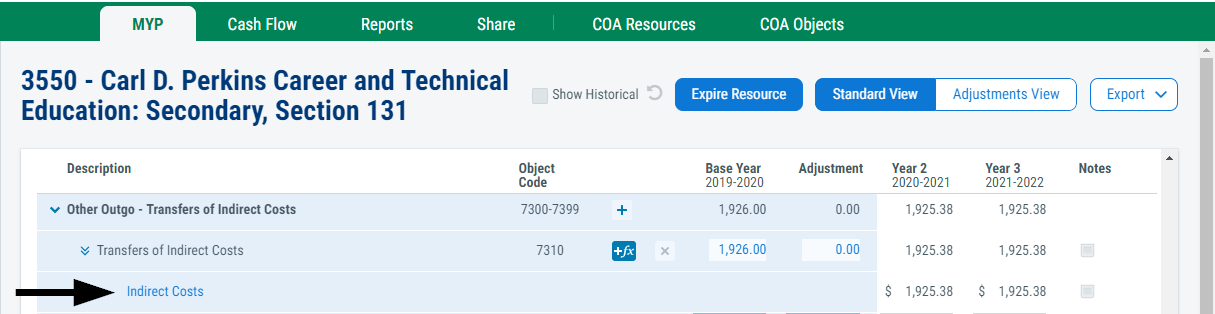

Maximum by Award

This method divides the award amount (SACS objects 8010-8799) by 1.xx, where xx equals the decimal equivalent of the 'Applied Rate,' then subtracts the result from the original award amount. Custom object codes are included in the calculation based on the SACS reference.

This method automatically recalculates as changes are made in the multiyear projection.

| Description | Year 2 | Year 3 |

|---|---|---|

| 1. Retrieve the resource award from the 'Resources' screen, SACS objects 8010-8799 | $40,433.00 | $40,433.00 |

| 2. Convert the 'Applied Rate' to decimal | 5.0000% = .050000 | 5.0000% = .050000 |

| 3. Calculate value of expenditures that allow indirect costs to fit within the award | 40,433.00 / (1 + .05) = $1,925.38 | 40,433.00 / (1 + .05) = $1,925.38 |

| 4. Apply the result in the 'Indirect Costs' assumption | $1,925.38 | $1,925.38 |

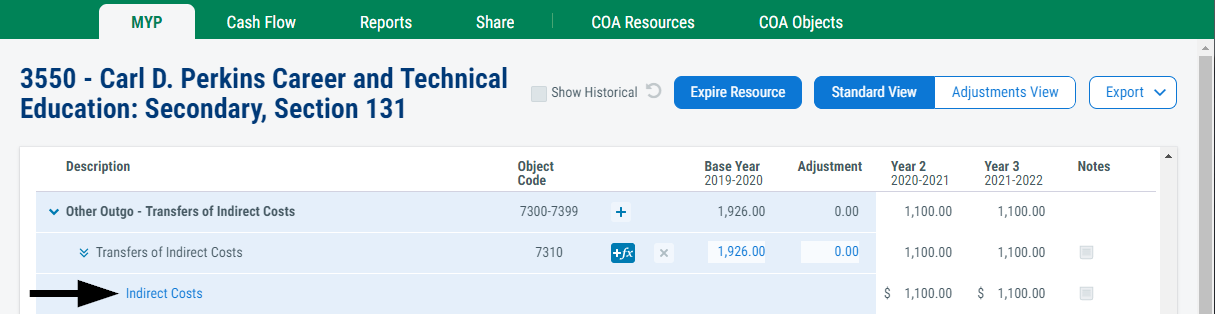

Other

When neither of the above automated methods calculates the desired result due to special program restrictions, local processes or local policies, manually calculate the desired indirect cost and enter it on the 'Other' line.

Because this method is based on a determination or calculation outside of the software, this method does not automatically recalculate as changes are made in the multiyear projection.

| Description | Year 2 | Year 3 |

|---|---|---|

| 1. Enter the manually calculated indirect costs value | $1,100.00 | $1,100.00 |

| 2. Apply the result in the 'Indirect Costs' assumption | $1,100.00 | $1,100.00 |

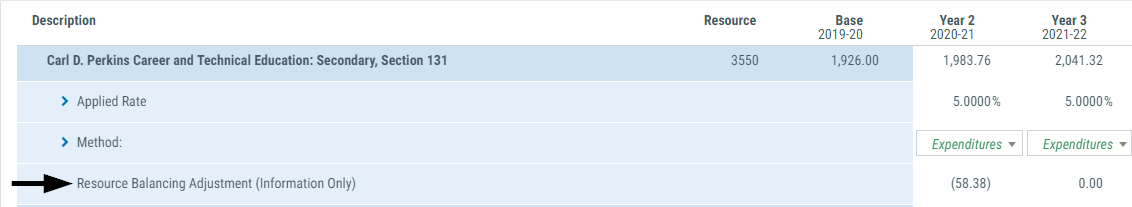

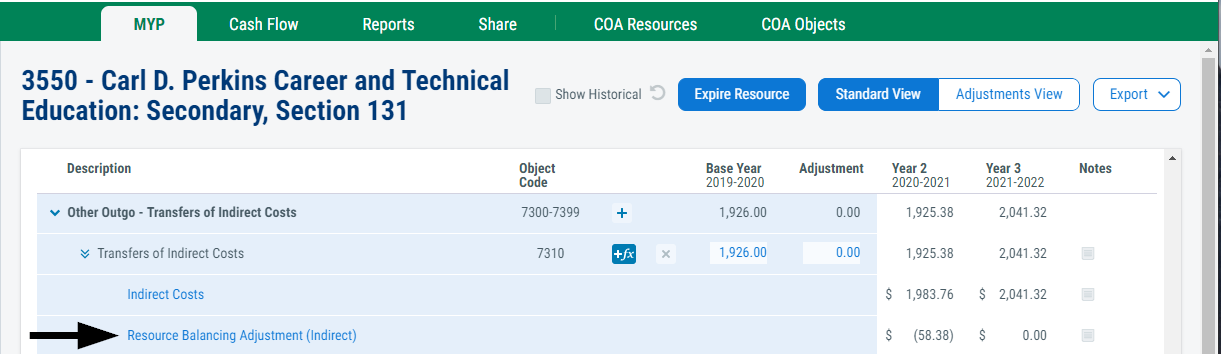

6. Resource Balancing Adjustment Offset

The 'Resource Balancing Adjustment' displays the offset to indirect costs due to expenditure adjustments made on the 'Contributions/Balancing' screen to balance a resource.

This line is displayed as a separate assumption in the multiyear projection screen to better track and display the total value of balancing adjustments made to a resource.