Reserves

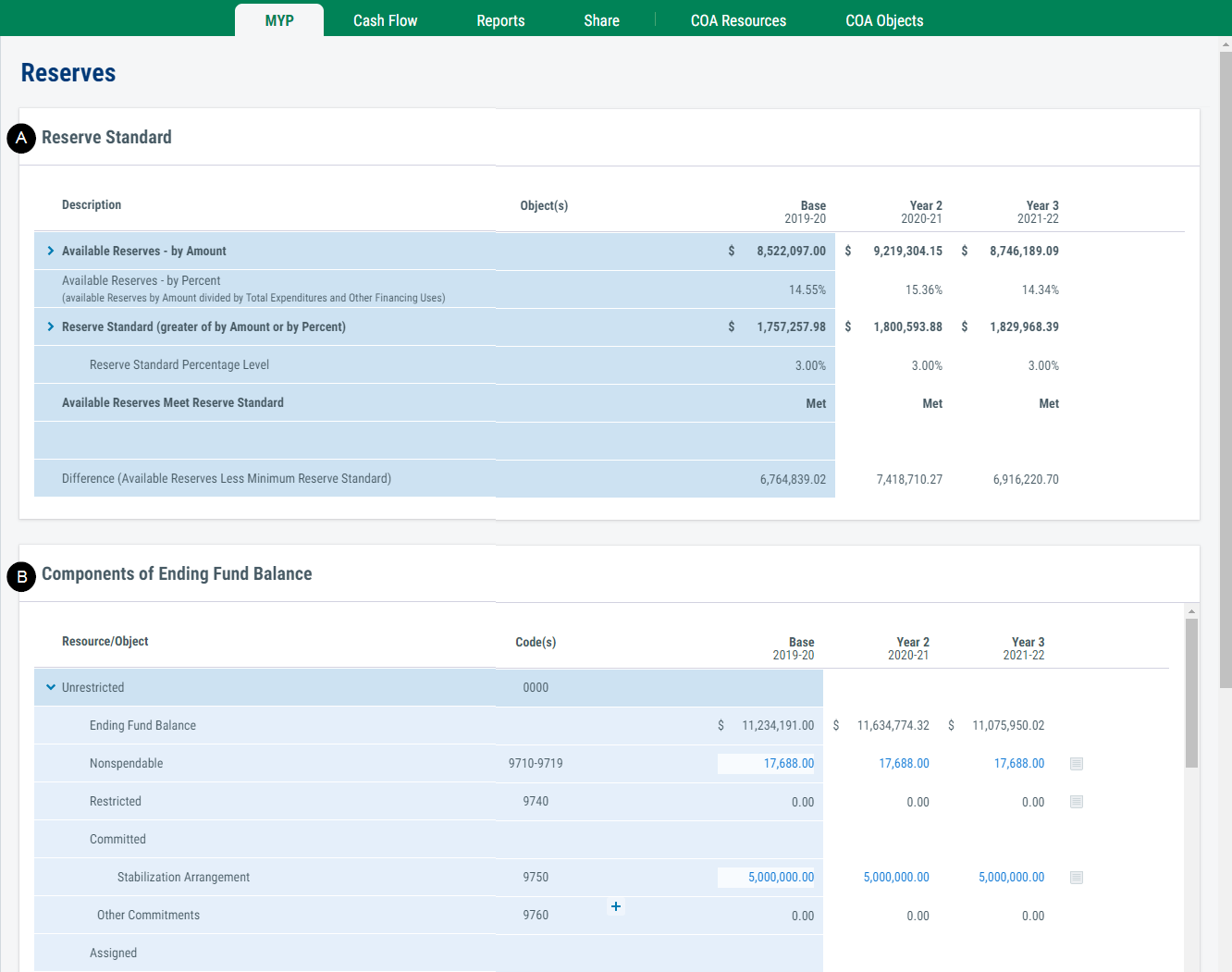

The 'Reserves' screen has two purposes:

- to project the components of ending fund balance and

- to determine if the LEA meets the required minimum reserve in the general operating fund.

Sections

The 'Reserves' screen contains two sections:

A. Reserve Standard

B. Components of Ending Fund Balance

Note that the section details vary based on the LEA and fund type.

By default, only the highlights of each section are displayed. To display or hide more details, click the expand and collapse icons. When the icon points to the right, the section is collapsed. And when the icon points down, the section is expanded.

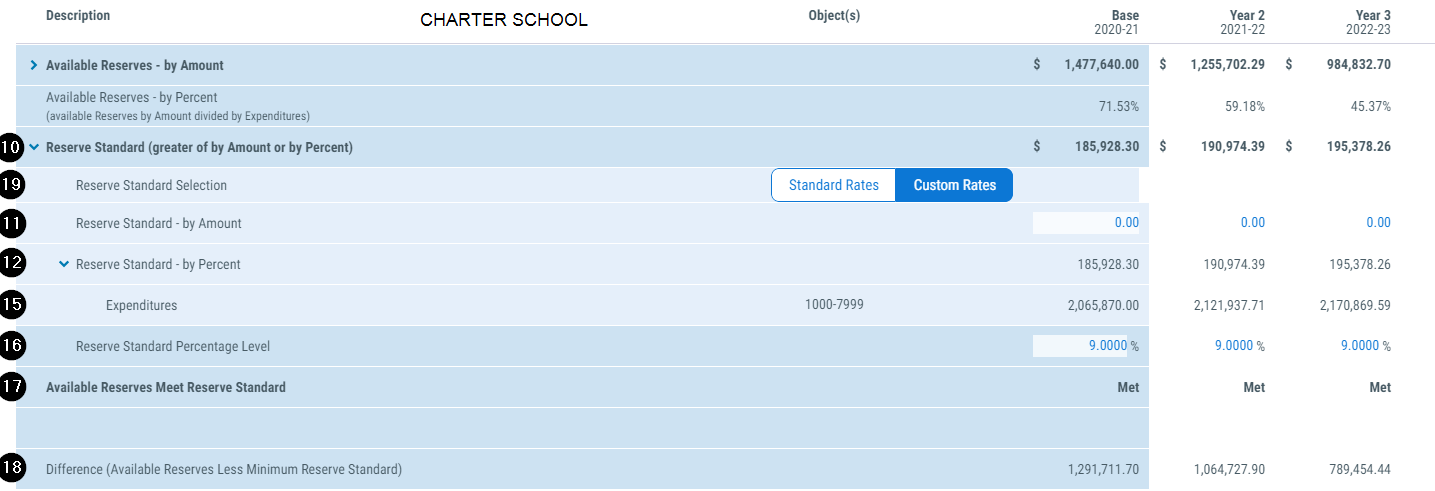

![]()

A. Reserve Standard

The 'Reserve Standard' section and calculation mirrors the SACS software criterion for reserves for school districts and county offices. This section also appears for charter school projections as a best practice. This section only applies for the following fund types:

- General Fund and County School Service Fund, SACS fund 01

- Charter Schools Special Revenue Fund, SACS fund 09

- Charter Schools Enterprise Fund, SACS fund 62

- Charter Alternative Format, modified accrual

- Charter Alternative Format, full accrual

Projections for funds excluded from the above list will not see the 'Reserve Standard' section.

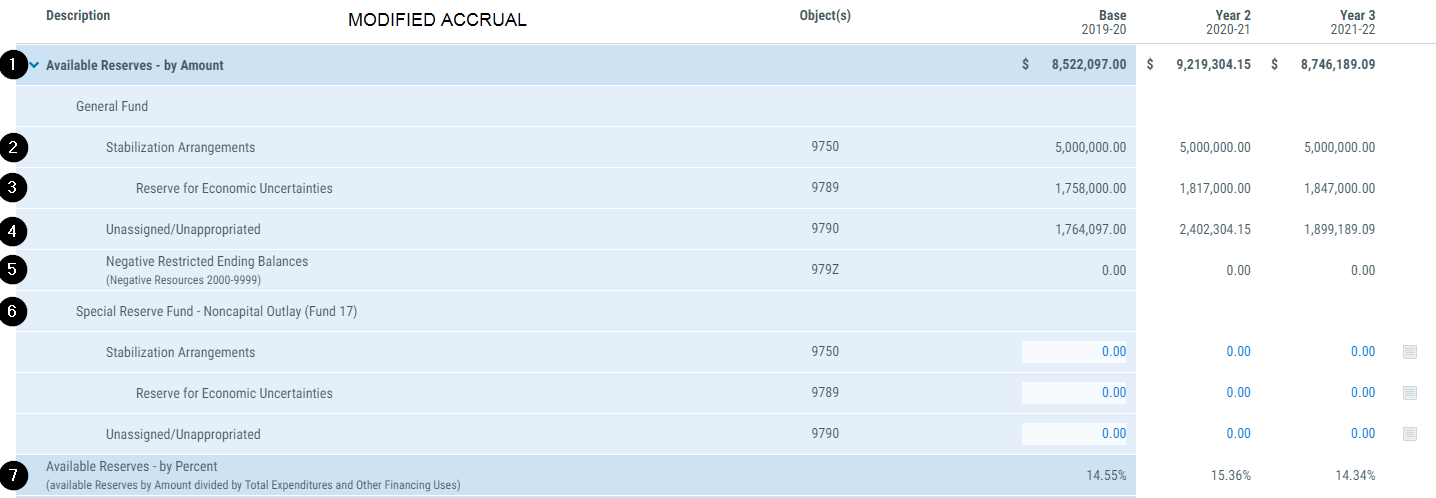

Calculation of Available Reserves

The first step in determining whether the LEA meets the minimal required reserve is to calculate available reserves. The detail lines for the calculation varies based on if the projection is modified accrual or full accrual. Governmental funds, SACS funds 01-60, are modified accrual basis. Proprietary funds and fiduciary funds, SACS funds 61-95, are full accrual basis.

1. Available Reserves - by Amount

This row displays the total calculated reserves available based on the detail lines in the expanded area. This value is compared to the reserve standard to determine whether the LEA meets the requirement.

2. Stabilization Arrangements

This row displays the total of any Stabilization Arrangements values, SACS object 9750, entered in the Components of Ending Fund Balance section of the screen. These funds are available to meet the minimum required reserve.

This row displays only in modified accrual projections.

3. Reserve for Economic Uncertainties

This row displays the total of any Reserve for Economic Uncertainties values, SACS object 9789, entered in the Components of Ending Fund Balance section of the screen. These funds are available to meet the minimum required reserve.

This row displays only in modified accrual projections.

4. Unassigned/Unappropriated

This row displays the total of any unrestricted Unassigned/Unappropriated values, SACS object 9790, entered in the Components of Ending Fund Balance section of the screen. These funds are available to meet the minimum required reserve.

This row displays only in modified accrual projections.

5. Negative Restricted Ending Balances

This row displays the total of any negative restricted Unassigned/Unappropriated values, SACS object 9790, entered in the Components of Ending Fund Balance section of the screen. These funds reduce the unrestricted funds available to meet the minimum required reserve.

This row displays only in modified accrual projections.

6. Special Reserve Fund - Noncapital Outlay

This area allows an LEA to include funding reserves held in the Special Reserve Fund - Noncapital Outlay, SACS fund 17. By default, these values are $0.00. To include available SACS fund 17 funds in the calculation, project and enter values for each of the listed categories:

This area displays only in modified accrual projections. Also, it does not display for charter alternative format projections.

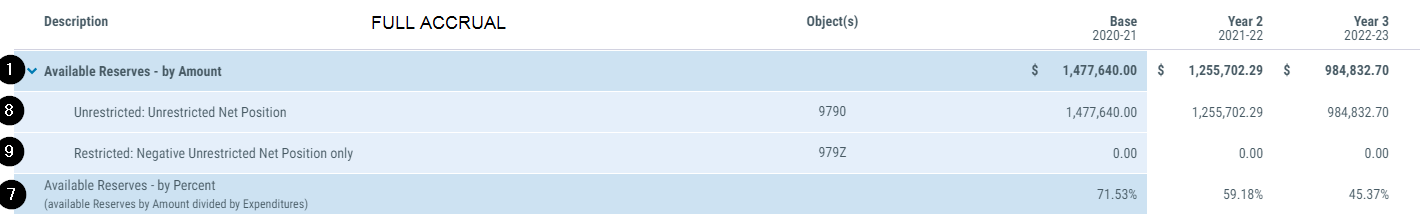

7. Available Reserves - by Percent

This row calculates the available reserve percentage by dividing the available reserves by total expenditures and other financing uses (if applicable). The row is informational only and does not determine whether an LEA meets the reserve requirement. However, it is a metric that many LEAs monitor and compare.

8. Unrestricted: Unrestricted Net Position

This row displays the total of any unrestricted net position values, SACS object 9790, entered in the Components of Ending Fund Balance section of the screen. These funds are available to meet the minimum required reserve.

This row displays only in full accrual projections.

9. Restricted: Negative Unrestricted Net Position Only

This row displays the total of any negative restricted net position values, SACS object 9790, entered in the Components of Ending Fund Balance section of the screen. These funds reduce the unrestricted funds available to meet the minimum required reserve.

This row displays only in full accrual projections.

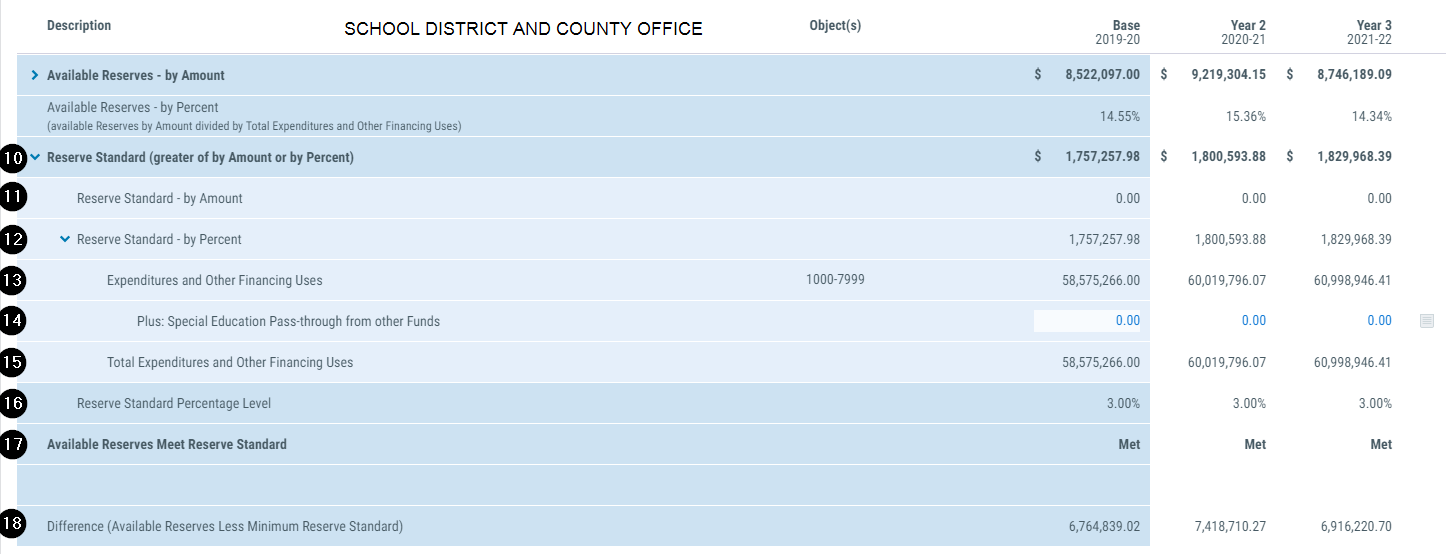

Reserve Requirement

After calculating the available reserves, the next step in determining whether the LEA meets the minimum required reserve level is to calculate the minimum required reserve.

The detail lines vary based on the LEA type: school district, county office or charter school. SACS funds 09 and 62 are displayed as charter schools, even if the projection is technically under the CDS code of a school district or county office of education.

10. Reserve Standard

This row displays the calculated minimum required reserve standard in dollars. This value is compared to the available reserves to determine whether the LEA meets the minimum reserve requirement. It is calculated by comparing the reserve standard amount and reserve standard percentage in dollars and displaying the greater value.

11. Reserve Standard - by Amount

This row displays the minimum reserve standard in dollars, if applicable. Minimum dollar values are applicable to county offices, small school districts and small charter schools that calculate their minimum reserve requirement per the standard school district formula. For charter schools, this field may be manually entered if the 'Reserve Standard Selection' field is set to 'Custom Rates.' For LEAs that don't have a minimum reserve standard in dollars, this field will display $0.00.

For current reserve tables, please see the CDE's SACS Financial Reporting software and documentation.

12. Reserve Standard - by Percent

This row displays the minimum reserve standard percentage converted to dollars. This field is calculated by multiplying the Total Expenditures and Other Financing Uses, or Expenditures if the LEA is a charter school, and the reserve standard percentage.

For current reserve tables, please see the CDE's SACS Financial Reporting software and documentation.

13. Expenditures and Other Financing Uses

This row retrieves the expenditure and other financing uses activity in objects 1000-7999 and custom referenced objects.

This row displays only in school district and county office projections.

14. Special Education Pass-Through from Other Funds

This row allows an LEA to include special education pass-through activity from other funds in the calculation to determine the minimum reserve. By default, these values are $0.00. To include the activity, project and enter the values for each projection year.

This row displays only in school district and county office projections.

15. Total Expenditures and Other Financing Uses

This row sums the 'Expenditures and Other Financing Uses' row and 'Special Education Pass-through from Other Funds' row. For charter schools, it retrieves the expenditures activity in SACS objects 1000-7999 and custom reference objects. The value in this field is used to calculate the minimum reserve requirement.

16. Reserve Standard Percentage Level

This row displays the minimum reserve standard percentage rate. For school districts and county offices, this rate is determined per the requirements and tables in the CDE's SACS Financial Reporting software. For charter schools, this field may be manually entered if the 'Reserve Standard Selection' field is set to 'Custom Rates.'

For current reserve tables, please see the CDE's SACS Financial Reporting software and documentation.

17. Available Reserves Meet Reserve Standard

This row makes the determination if the LEA meets the minimum reserve requirement for each fiscal year contained in the projection. If the available reserves in dollars is greater than the reserve standard in dollars, the LEA has met the requirement, and the row will say 'Met.' If the available reserves in dollars is less than the reserve standard in dollars, the LEA does not meet the requirement, and the row will say 'Not Met.'

18. Difference

This informational row displays the dollar difference between the available reserves and reserve requirement. It does not appear on any reports and is meant for internal use only.

19. Reserve Standard Selection

Charter schools should select the reserve standard option toggle that best meets their local agreement for a minimum required reserve.

- 'Standard Rates'

This option applies the school district minimum reserve requirement formula to the charter school. The reserve rate and minimum dollar amount are based on student enrollment for each fiscal year. - 'Custom Rates'

This option allows the charter school to enter a custom rate and minimum reserve amount.

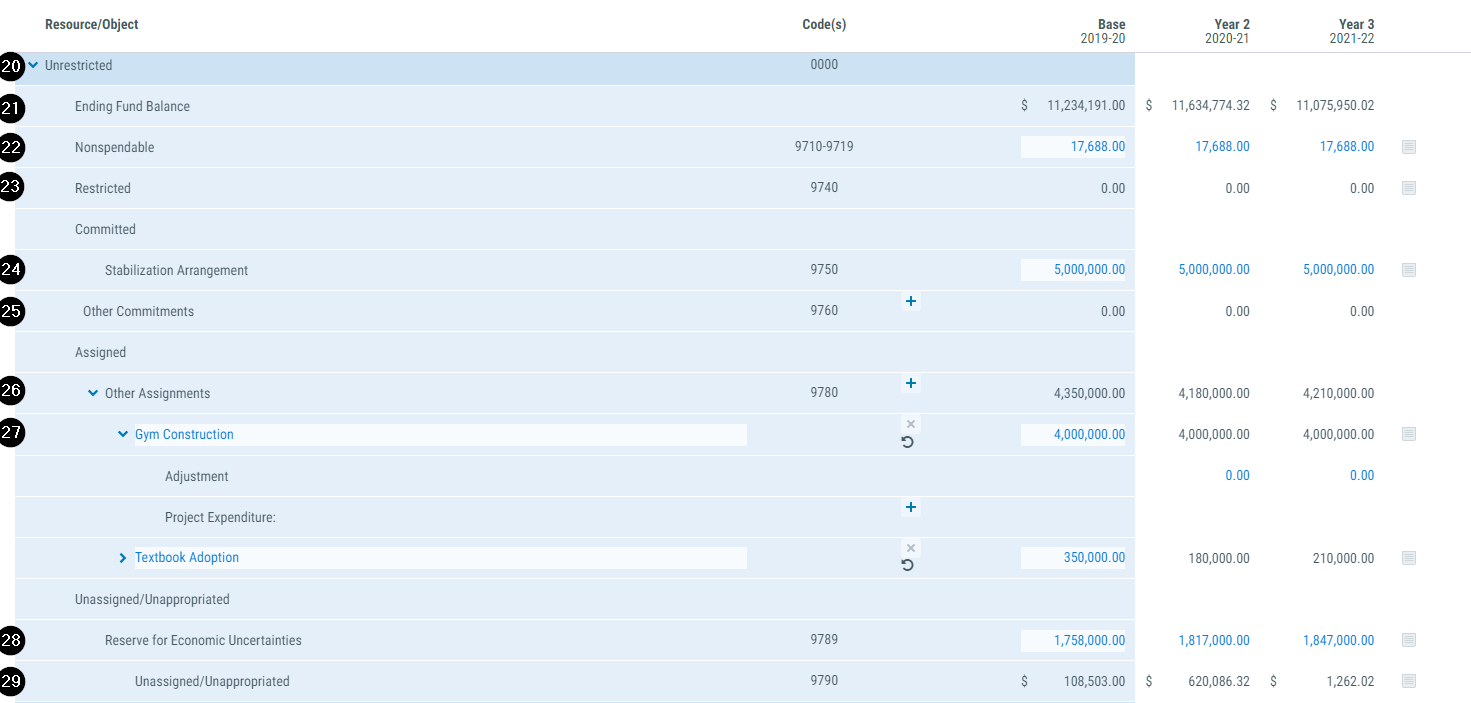

B. Components of Ending Fund Balance

The 'Components of Ending Fund Balance' section is designed for LEAs to communicate limitations and local priorities on the ending fund balance. The detail lines are specific to whether the projection is modified accrual or full accrual. Governmental funds, SACS funds 01-60, are modified accrual basis. Proprietary funds and fiduciary funds, SACS funds 61-95, are full accrual basis.

Modified Accrual

20. Resource

This row displays the resource description and code to be defined. By default, resource 0000 is expanded and all other resources are collapsed. All resources in the projection are automatically displayed in the 'Reserves' screen; therefore, there is no way to add or remove resources in this screen.

21. Ending Fund Balance

This row retrieves the 'Ending Balance/Net Position, June 30' from the 'Resources' screen by resource to begin the process to identify the components of ending fund balance.

22. Nonspendable

From the California Department of Education's (CDE's) guidance manual, the California School Accounting Manual (CSAM):

Nonspendable fund balance (objects 9710–9719) is the portion that is not available for expenditure because it is not in spendable form or is legally or contractually required to remain intact. For example, Stores, Prepaid Expenditures, and Revolving Cash are not available for spending, so the portion of fund balance represented by these items must be classified as nonspendable.

23. Restricted

From the California Department of Education's (CDE's) guidance manual, the California School Accounting Manual (CSAM):

Restricted fund balance (objects 9730–9749) is the portion that is subject to externally imposed or legally enforceable constraints by external resource providers or through constitutional provisions or enabling legislation.

This field is calculated automatically. If the resource is restricted, the system subtracts any nonspendable balance from the ending fund balance. Unrestricted resources are displayed as $0.00.

24. Stabilization Arrangement

From the California Department of Education's (CDE's) guidance manual, the California School Accounting Manual (CSAM):

Committed fund balance (objects 9750–9769) is the portion in which the use is constrained by limitations imposed by the LEA through formal action of its highest level of decision-making authority. It would include amounts set aside pursuant to an economic stabilization arrangement only if the arrangement were more formal than the reserve for economic uncertainties recommended by the Criteria and Standards for Fiscal Solvency.

This row is only available for unrestricted resources. This field requires manual entry.

25. Other Commitments

From the California Department of Education's (CDE's) guidance manual, the California School Accounting Manual (CSAM):

Committed fund balance (objects 9750–9769) is the portion in which the use is constrained by limitations imposed by the LEA through formal action of its highest level of decision-making authority.

This row is only available for unrestricted resources.

26. Other Assignments

From the California Department of Education's (CDE's) guidance manual, the California School Accounting Manual (CSAM):

Assigned fund balance (objects 9770–9788) is the portion intended to be used for specific purposes but for which the constraints do not meet the criteria to be reported as restricted or committed.

This row is only available for unrestricted resources.

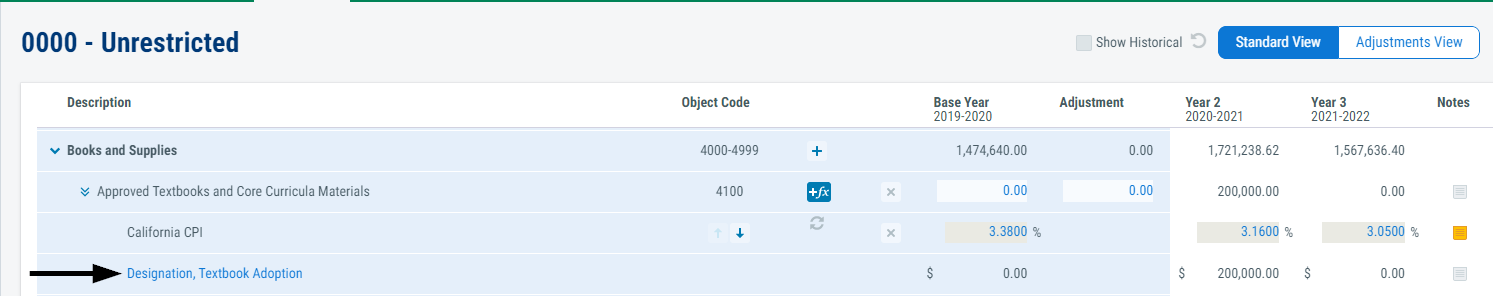

27. Other Assignment or Other Commitment Details

To create details:

- Click the '+' icon on the 'Other Commitments' or 'Other Assignments' line to add a detail

- Enter a description for the detail

- Enter a reserve value in the first projection year the detail exists

- Enter any applicable increases or decreases due to available funding as an adjustment

- Click the '+' icon on the 'Project Expenditure' line to add related expenditure activity to the multiyear projection

- Select an object to assign the activity in the multiyear projection

- Enter the value of the activity in the fiscal year it will occur

This row is only available for unrestricted resources.

This feature creates a 'Reserves' assumption in the multiyear projection:

28. Reserve for Economic Uncertainties

From the California Department of Education's (CDE's) guidance manual, the California School Accounting Manual (CSAM):

The portion of unassigned fund balance set aside pursuant to a minimum fund balance policy. This amount includes the reserve recommended by the Criteria and Standards for Fiscal Solvency, as well as additional reserve amounts established pursuant to local policy. Object 9789 is available in Fund 01 and Fund 17.

This row is only available for unrestricted resources. This field requires manual entry.

29. Unassigned/ Unappropriated

From the California Department of Education's (CDE's) guidance manual, the California School Accounting Manual (CSAM):

In the general fund, residual fund balance in excess of amounts reported in the nonspendable, restricted, committed, or assigned fund balance classifications and net of Object 9789, Reserve for Economic Uncertainties. In all governmental funds including the general fund, the excess of nonspendable, restricted, and committed fund balance over total fund balance (deficits). Assigned amounts must be reduced or eliminated if a deficit exists.

This field is calculated.

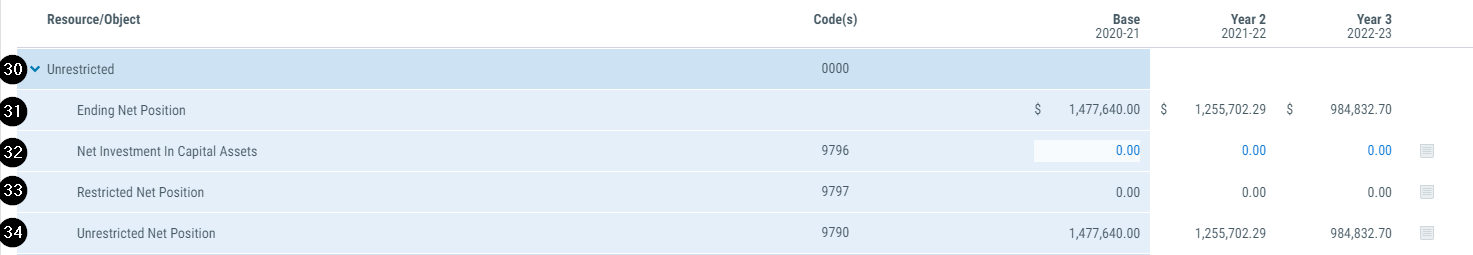

Full Accrual Funds

30. Resource

This row displays the resource description and code to be defined. By default, resource 0000 is expanded and all other resources are collapsed. All resources in the projection are automatically displayed in the 'Reserves' screen; therefore, there is no way to add or remove resources in this screen.

31. Ending Net Position

This row retrieves the 'Ending Balance/Net Position, June 30' from the 'Resources' screen by resource to begin the process to identify the components of ending fund balance.

32. Net Investment in Capital Assets

From the California Department of Education's (CDE's) guidance manual, the California School Accounting Manual (CSAM):

The portion of net position that represents capital assets, net of accumulated depreciation and less outstanding debt directly related to the capital assets. It includes deferred outflows of resources and deferred inflows of resources associated with the capital assets. This account is used only in funds 61 through 73.

This field requires manual entry.

33: Restricted Net Position

From the California Department of Education's (CDE's) guidance manual, the California School Accounting Manual (CSAM):

The portion of net position representing resources subject to legally enforceable constraints externally imposed either by external resource providers (e.g., grantors or creditors) or by law through constitutional provisions or enabling legislation. Restricted assets are reduced by liabilities and deferred inflows of resources associated with those assets. Also includes permanent fund principal. This account is used only in funds 61 through 73.

This field requires manual entry.

34. Unrestricted Net Position

From the California Department of Education's (CDE's) guidance manual, the California School Accounting Manual (CSAM):

In the proprietary and fiduciary funds, the amount of net position not included in the determination of net investment in capital assets or restricted net position.

Resources and Resource Summary Views

Information from this section is displayed on the 'Resources' and 'Resources Summary' views.